Maryland car accident law is a complex field that covers multiple aspects of automobile accidents, insurance, liability, and compensation for victims. In this comprehensive guide, we will discuss how accident claims are valued for settlement, uninsured motorist law, contributory negligence, Personal Injury Protection (PIP) insurance, and the minimum car insurance requirements in Maryland. We will also look at the average payout in Maryland car accident cases and summarize some recent settlements and verdicts.

Determining Settlement Amounts in Maryland

Before we dig into the law, victims what to talk about how their claims are valued for settlement because they want to know what their car accident claim is worth. This process involves evaluating the extent of the injuries, property damage, and other losses suffered by the victims. Several key factors are considered when valuing a claim, including:

- Medical expenses: The cost of medical treatment, rehabilitation, and any ongoing care required due to the accident.

- Lost wages: The amount of income lost as a result of being unable to work due to injuries sustained in the accident.

- Pain and suffering: Compensation for the physical pain, emotional distress, and reduced quality of life experienced by the victim.

- Property damage: The cost of repairing or replacing damaged vehicles or other property.

- Future losses: Any expected future medical expenses, lost wages, or diminished earning capacity caused by the accident.

Insurance adjusters and attorneys often use various methods to calculate the value of these damages. For instance, they might apply a multiplier to the total economic damages (medical expenses and lost wages) to account for pain and suffering. Additionally, Maryland follows the “collateral source rule,” which prohibits the reduction of damages based on payments received from other sources (e.g., health insurance).

Maryland Uninsured Motorist Law

Maryland’s uninsured motorist (UM) law requires insurance companies to offer UM coverage as part of every automobile liability insurance policy. This coverage protects drivers and passengers if they are injured in an accident caused by an uninsured or underinsured motorist or a hit-and-run driver.

The minimum UM coverage limits in Maryland are:

- $30,000 for bodily injury per person

- $60,000 for bodily injury per accident

- $15,000 for property damage

If the at-fault driver does not have sufficient insurance coverage to cover the damages, UM coverage will cover the difference, up to the policy limits. It is essential to note that UM claims are subject to the same deadlines and procedural requirements as other auto accident claims, including the three-year statute of limitations for filing a personal injury lawsuit.

Contributory Negligence

Maryland is one of the few states that follow the contributory negligence rule, which can significantly impact car accident claims. Under this rule, a victim who is found to be even partially at fault for an accident is barred from recovering any damages from other parties involved.

For example, if a driver is found to be 10% at fault for a car accident, they would be unable to recover any compensation from the other driver, even if the other driver was 90% at fault. This harsh rule often results in victims receiving no compensation, even if their role in the accident was minimal.

Personal Injury Protection (PIP) Insurance

PIP insurance is a no-fault insurance coverage that provides compensation for medical expenses and lost wages, regardless of who is at fault for the accident. Maryland law requires insurance companies to offer PIP coverage with every auto insurance policy, but drivers can choose to waive this coverage in writing.

The minimum PIP coverage limits in Maryland are $2,500 per person for medical expenses and lost wages. Remember that PIP coverage does not compensate for pain and suffering, and it is subject to specific deadlines for filing a claim (usually within one year of the accident).

Minimum Car Insurance Requirements in Maryland

Maryland law requires all drivers to carry a minimum amount of auto insurance coverage to operate a vehicle legally. The minimum car insurance requirements in Maryland are:

- Bodily Injury Liability: $30,000 per person and $60,000 per accident. This coverage pays for the medical expenses, lost wages, and other damages sustained by the other driver, passengers, or pedestrians involved in an accident caused by the policyholder.

- Property Damage Liability: $15,000 per accident. This coverage pays for damage to the other driver’s vehicle or any other property damaged in an accident caused by the policyholder.

- Uninsured/Underinsured Motorist Bodily Injury: $30,000 per person and $60,000 per accident. This coverage protects the policyholder and their passengers if they are injured in an accident caused by a driver without insurance or with insufficient insurance coverage. Uninsured Motorist Property Damage: $15,000 per accident. This coverage pays for damage to the policyholder’s vehicle or other property if the at-fault driver does not have insurance or has insufficient coverage.

These are the minimum coverage limits required by Maryland law. Drivers can choose to purchase higher coverage limits or additional coverage options, such as collision and comprehensive coverage, to better protect themselves financially in the event of an accident. Should you have more coverage? You should.

Statute of Limitation for a Car Accident in Maryland

If you are seriously injured in a car accident, the only way to get full and fair compensation from the insurance companies is usually to file a personal injury lawsuit against the at-fault driver. If you are considering an auto accident lawsuit, you need to be aware of the Maryland statute of limitations for personal injury claims. Maryland’s statute of limitations for auto accident lawsuits is 3-years. This means that if you don’t file a lawsuit within 3-years of the date of the car accident, your case will be time-barred.

There is one major exception to this rules that applies if the injured plaintiff is a minor at the time of the accident. For minors (anyone under age 18) the Maryland 3-year statute of limitation does not begin to run until they turn 18. So if you were under 18 when the accident happened, you will have until your 21st birthday to file a lawsuit.

Proving Negligence in Maryland Car Accidents

Car accident lawsuits in Maryland are almost always based on negligence claims, which means that the other driver did something wrong. This could be because the negligent driver ran a red light, didn’t pay attention, rear-ended a stopped car, or made an unsafe lane change.

To establish that the other driver was negligent and, therefore, at-fault for the accident, the plaintiff must convince the jury (or judge) that they failed to act with the level of care that a reasonable driver in similar circumstances would have used. In many cases, the other driver’s violation of a traffic law can be used as evidence of negligence (e.g., running a red light, failing, to yield, etc.). For a judge to decide that the violation of the law is ample proof of negligence, he must find that the law was designed to prevent the type of harm that occurred.

Defenses in Maryland Car Accident Cases

There are basically 2 primary defenses plaintiffs can expect to face in Maryland car accident lawsuits: (1) contributory negligence, and (2) disputed damages/injuries.

Contributory Negligence

Maryland is one of only a small handful of jurisdictions that continues to follow the traditional doctrine of contributory negligence as a defense in negligence cases. Under the rule of contributory negligence, if a plaintiff’s own negligence contributes in any way to causing the accident they are supposed to be barred from recovering any damages at all. Contributory negligence is asserted as an affirmative defense in almost every auto accident case in Maryland.

Here is an example of how contributory negligence theoretically works as a defense in Maryland auto accident lawsuits. Let’s say Jack and Jill are involved in an auto accident and the circumstances of the accident make it somewhat unclear which one was at fault. Jack sues Jill and the case goes to trial. The jury is asked to assign a fault percentage to each party. The jury finds that Jill was 90% at-fault and Jack was 10% at-fault for the accident. Under Maryland’s contributory negligence rule, this means that Jack is completely barred from recovering damages from Jill. He gets nothing.

Despite the apparent harshness of the contributory negligence defense, it rarely works in the mechanical fashion described above. In most auto accident cases, liability or fault is placed entirely on one driver or the other, without any apportionment.

Disputed Damages/Injuries

The other primary defense strategy plaintiffs can expect to face in auto accident cases is a dispute about the extent or severity of their injuries and whether they are actually related to an auto accident or a pre-existing condition. This type of defense is very common, especially in cases involving soft tissue back and neck injuries.

The insurance company for the other driver will claim that the plaintiff is exaggerating their injuries, or that their injuries were pre-existing or from old age rather than something caused in the accident. The insurance company will also dispute the validity of medical treatment and medical expenses claimed by the plaintiff based on the same general principles.

Collateral Source Rule

In Maryland auto accident cases, plaintiffs can get compensation for medical expenses even when those expenses have already been covered by insurance. This is known as the collateral source rule. The collateral source rule is based on the idea that negligent drivers should be held responsible for the full value of the harm they cause, regardless of whether the plaintiff has insurance or another source of recovery. Here are some examples:

- Jack is injured in an auto accident caused by Jill. Jack undergoes $15,000 worth of treatment in the form of physical therapy, doctor’s visits, a hospital trip, etc. Jack has good health insurance, so almost all of that $15,000 was covered by his insurance. Jack only had to come out-of-pocket for his co-pays, which total just $120. Jill is still liable for the full $15,000 in medical expenses, even though Jack’s insurance covered them. If Jack gets a settlement, however, he may have to pay back a portion of those medical expenses to the insurance company (click here for more on medical liens).

- Jack has PIP insurance, which pays all of his medical bills. Jill is still liable to pay for those damages, she does not get to benefit from Jack’s payment of insurance premiums.

- Jack missed 2 weeks of work due to the accident, but he had sufficient sick time or vacation time to ensure that he did not lose any wages while injured from that accident. Jill can still be held liable for lost wages because Jack lost his use of those sick and vacation days.

Average Value of Maryland Car Accident Cases

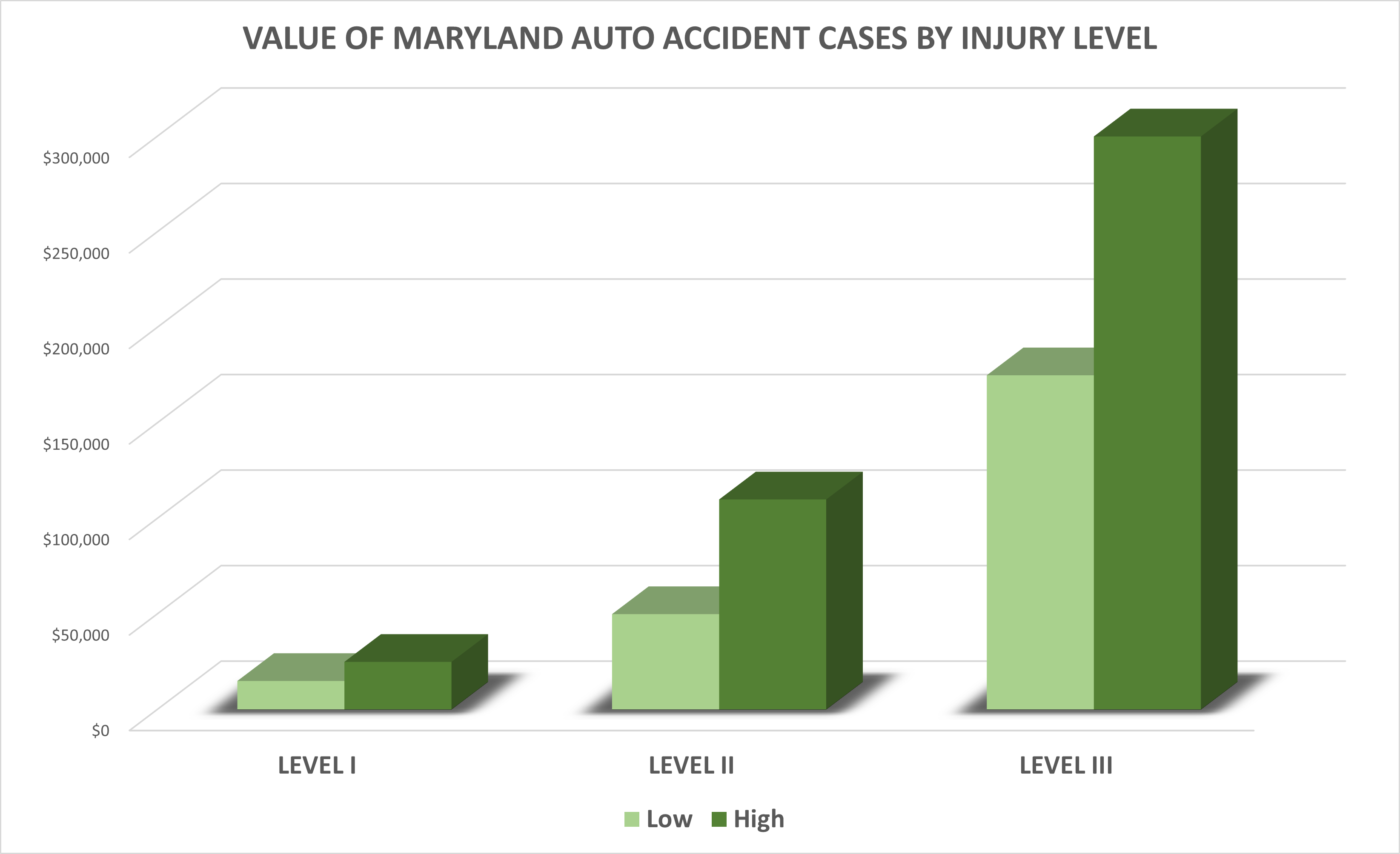

The average value of a Maryland auto accident injury case varies depending on the severity level of the plaintiff’s injuries. For relatively minor injuries (Level I), such as soft tissue sprains, whiplash, etc., the average settlement value of an auto accident case is around $15,000 to $25,000. For moderate severity (Level II) injuries, such as bone fractures, herniated discs, etc., the average value increases to $50,000 to $110,000. For the most serious injuries (Level III), including death, brain injuries and other permanent injuries, the average value can be $175,000 to $300,000.

Maryland Car Accident Verdicts and Settlements

Below are verdicts and reported settlements from recent Maryland auto accident injury lawsuits.

- $850,000 Settlement (Queen Anne’s County 2024): Our client was traveling south on a two-lane highway and was struck by the defendant, who was crossing the highway and entered directly into the plaintiff’s lane. This resulted in a severe collision, exacerbated by the fact that the defendant was obligated to stop, indicated by a stop sign and a flashing red light at the intersection. The collision caused the plaintiff to sustain extensive injuries, a cervical disc herniation and a fractured ankle. While he ultimately had a great recovery, these injuries significantly impacted his mobility for an extended period. He had $80,000 in medical bills. His case settled for more than ten times his specials with a payout of $850,000.

- $30,000 Verdict (Baltimore County 2024): The plaintiff was driving south on York Road when her vehicle was allegedly rear-ended by the defendant. The plaintiff alleged that she suffered various injuries (which were not described in the verdict summary). Liability was admitted and the case went to trial on damages only.

- $350,451 Verdict (Baltimore City 2023): A woman was struck from behind by a police officer as she was preparing to merge onto Charles Street. The officer, on a non-emergency mission to serve a warrant in Baltimore City, had been on duty throughout the previous night, with the incident occurring around 10:30 a.m. Due to the impact, the woman sustained significant injuries, resulting in pain and medical expenses. Following a car accident lawsuit, a Baltimore County jury awarded the injured driver more than $350,000 due to the officer’s negligence.

- $60,000 Verdict (Baltimore City 2023): The plaintiff claimed to suffer abdominal strain, cervical and lumbar sprain/strain, and bilateral shoulder strains after the vehicle she was driving westbound, turning left at an intersection pursuant to a green arrow, collided with an eastbound vehicle operated by the defendant. Jury in Baltimore City awarded $60,000.

- $22,000 Settlement (Baltimore City 2023): The plaintiff claimed to suffer a lumbar back strain, with sciatica, as well as a right knee contusion, and a head injury with post-traumatic headaches after the cab in which she was a passenger was in an accident. She brought suit against the cab driver.

- $200,000 Verdict (Baltimore County 2023): The plaintiff reportedly suffered injuries to her shoulder, neck, head, wrist, chest, and limbs when she was struck by an uninsured driver who made a left turn in front of her vehicle. She filed suit against her insurance company, State Farm, after it refused to cover her damages under her UIM coverage. Case went to trial in Baltimore County.

- $112,500 Verdict (Baltimore City 2023): The plaintiff was in a parking lot loading groceries into the back of his vehicle when the defendant backed his vehicle out of a parking spot across the lane from the plaintiff. The defendant’s vehicle struck the plaintiff’s shopping cart, which then struck the plaintiff and pinned him to his vehicle causing injuries to his back, left knee, and left elbow.

- $55,925 Verdict (Baltimore City 2022): The plaintiff sustained a right wrist fracture, resulting in permanent loss of function and pain, when his vehicle was T-boned at an intersection by a vehicle driven by an uninsured driver. He filed suit against his insurance company, State Farm, for UIM coverage.

- $5,405 Verdict (Baltimore County 2022): The plaintiff claimed to suffer mental anguish, depression and other mental health problems and physical injuries after her northbound vehicle, stopped for heavy traffic ahead, was rear-ended by the defendant. The small verdict in this case is probably a reflection of the jury’s negative view of the plaintiff and her claims.

- $20,000 Verdict (Baltimore City 2022): The plaintiff, a 59-year-old woman, was walking on the sidewalk when the defendant backed into her. She suffered comparatively minor injuries for a pedestrian accident (sprained shoulder and hip, plus contusions and abrasions). The award included $8,300 for medical expenses and the rest for pain and suffering.

- $20,000 Verdict (Baltimore City 2022): The 20-year-old female plaintiff said she was driving south when a vehicle operated by the defendant, under the influence of alcohol, struck her vehicle. The plaintiff allegedly suffered injuries that included cervical, thoracic and lumbar muscle spasms and sprain/strains, rhomboid spasms and inflammation of the superior occipital nerve.

Maryland Car Accident Lawsuit FAQs

What is the average settlement for a car accident in Maryland?

Settlement values depend on the severity of the injuries. Minor car accident cases in Maryland typically settle for $15,000 to $25,000, while moderate injury cases (fractures, herniated discs) can reach $50,000 to $110,000. Serious injury cases, including brain injuries, paralysis, or wrongful death, can range from $175,000 to over $300,000. However, the Maryland cap on non-economic damages can limit pain and suffering payouts in high-value cases.

How long does a car accident settlement take in Maryland?

The timeline for settling a car accident claim in Maryland can vary significantly depending on the circumstances of the case. Some claims resolve in a matter of months, while others can drag on for over a year—especially if a lawsuit is filed. Several factors influence how long it takes to reach a settlement:

-

Severity of Injuries – More serious injuries generally lead to longer settlement timelines an If you have ongoing medical treatment, surgeries, or rehabilitation, it is often best to wait until you have reached “maximum medical improvement” (MMI) before settling. This is frustraring to be sure. But if you settle you case before you get to MMI, you are really going to get an offer than it pennies on the dollar.

-

Liability Disputes – If the at-fault driver’s insurance company disputes who was responsible for the accident, it can significantly delay settlement negotiations. Maryland follows a strict contributory negligence rule, meaning if you are even 1% at fault, you are barred from recovery. Because of this, insurance companies frequently deny claims or stall settlement negotiations in cases where liability is contested.

-

Insurance Company Tactics – Insurance companies know that injured victims are often in financial distress due to medical bills and lost wages. They may intentionally delay the process, hoping you will accept a lowball settlement out of desperation. If the insurer refuses to negotiate in good faith, filing a lawsuit is often the only path to force them to take the claim seriously.

-

Complexity of Damages – Cases involving significant medical expenses, lost wages, or long-term disability require careful calculation of damages. If expert testimony (such as medical specialists or accident reconstructionists) is needed to prove the extent of injuries or fault, the process can take a little bit longer. But really the bottleneck in these case is waiting for the victim to finish treatment. We can usually get those ducks lined up pretty quickly.

-

Settlement Negotiations vs. Litigation – Some cases settle quickly in pre-litigation if the at-fault driver’s insurance company offers fair compensation. However, if an insurer refuses to make a reasonable offer, your attorney may need to file a lawsuit. Once a lawsuit is filed, the case enters the discovery phase, which can take 6-12 months before trial even begins.

-

Court Delays – If your case goes to trial, it may take even longer due to court backlogs. Maryland courts, particularly in Baltimore City, Prince George’s County, and Montgomery County, often have congested dockets, leading to delays of a year or more before trial.

So let’s estimate some timelines in general terms:

- Minor injury claims (soft tissue injuries, low medical bills) – 3 to 6 months

- Moderate injury claims (fractures, herniated discs, physical therapy) – 6 to 12 months

- Severe injury claims (permanent injuries, surgeries, long-term care) – 12 to 24 months

- Litigated cases that go to trial – 18 to 36 months

The best way to ensure your case does not get unnecessarily delayed is to work with the bestMaryland car accident attorney you can find who can push back against insurance company stalling tactics. While patience is often necessary to maximize your compensation, a skilled accident attorney will know when to negotiate aggressively and when to move forward with litigation.

Does Maryland have a minimum car accident settlement amount?

No, there is no minimum settlement for a Maryland car accident claim. Some cases settle for just a few thousand dollars, while others resolve for six- or seven-figure amounts. The key factors influencing settlement value include medical bills, lost wages, pain and suffering, and liability disputes.

What happens if I was partially at fault for the accident?

Maryland follows the harsh rule of contributory negligence. This means that if you are even 1% at fault, you are completely barred from recovering any compensation. Insurance companies love this rule because it gives them an easy way to deny claims. If liability is disputed, you need an aggressive attorney to push back against these tactics.

How does Maryland’s uninsured motorist law affect my case?

Maryland requires all drivers to carry uninsured motorist (UM) coverage. If you are hit by an uninsured or underinsured driver, your own insurance policy steps in to cover your damages up to your policy limits. However, UM claims can be just as difficult to negotiate as claims against another driver’s insurance company.

How do I prove negligence in a Maryland car accident case?

Proving negligence requires showing that the other driver violated their duty of care. Evidence such as police reports, traffic camera footage, witness testimony, and accident reconstruction can be critical. Maryland also recognizes negligence per se, meaning a driver who breaks a traffic law (e.g., running a red light) is automatically considered negligent (although that presumption can be rebutted with evidence).

What if my injuries seem minor? Should I still file a claim?

It really depends. If you have really minor injuries, you are going to get a really minor settlement. No amount of lawyering is going to make these settlement amounts any different. So is that worth the hassle? It depends on the person. There is no right or wrong answer. Everyone has the right to make a claim. You can exercise your rights or not.

What is the statute of limitations for filing a car accident lawsuit in Maryland?

Maryland has a strict three-year statute of limitations for personal injury lawsuits. If you do not file a lawsuit within three years from the date of the accident, you lose your right to seek compensation. An exception exists for minors—the three-year period does not begin until they turn 18.

What defenses do insurance companies use to deny Maryland car accident claims?

Insurance companies rely heavily on contributory negligence to deny claims. They also dispute the severity of injuries, arguing that they were pre-existing or unrelated to the accident. They may challenge medical treatment, claiming it was unnecessary or excessive. An experienced attorney can counter these arguments and ensure you get fair compensation.

How much auto insurance am I required to carry in Maryland?

Maryland law mandates minimum insurance coverage of:

- $30,000 for bodily injury per person

- $60,000 for bodily injury per accident

- $15,000 for property damage

- Uninsured/underinsured motorist coverage matching these amounts

Can I recover damages even if my medical bills were covered by insurance?

This is one of those areas where insurance companies want to quietly trick you.

Maryland’s collateral source rule allows accident victims to recover the full value of their medical bills and lost wages—even if insurance already covered them. This sounds straightforward, but insurance companies love to twist it to their advantage.

One common trick is claiming you should not be compensated for medical bills that health insurance already paid. They argue, or more likely imply without saying it directly, it would be “double-dipping,” which is false. The law ensures that the at-fault driver does not get a discount just because you had insurance.

The same applies to lost wages. If you took paid time off (PTO) or used sick days after an accident, you can still recover the value of those wages. The fact that your employer paid you does not mean the negligent driver gets off the hook.

Insurance companies often try to lowball settlements by using what was actually paid rather than the total billed amount. For example, if your medical bills totaled $50,000 but your health insurer negotiated them down to $15,000, the at-fault driver is still responsible for the full $50,000.

Never let the insurance company tell you that just because your health insurance covered your bills, you are not entitled to that money in a settlement. It is a trick—and it is one that works on too many people. A skilled Maryland car accident lawyer knows how to push back against these tactics and ensure you get the full compensation you deserve.

What types of damages can I recover in a Maryland car accident lawsuit?

Victims can seek compensation for:

- Medical expenses (past and future)

- Lost wages and reduced earning capacity

- Pain and suffering

- Property damage

- Emotional distress

- Loss of consortium (for spouses)

What is the biggest mistake people make after a car accident?

Not seeking medical treatment and waiting too long to call a lawyer. Many victims assume they are fine, only to develop serious symptoms later. Insurance companies pounce on any delay, arguing that if you did not seek immediate care, your injuries must not be that bad. Getting medical documentation right away and consulting an attorney early can make a huge difference in your case.

The second biggest mistake is hiring the guy who did you DWI five years ago. You want to hire the best car accident lawyer in Maryland that you can.

Do I need a lawyer for a minor car accident in Maryland?

For minor accidents with no injuries, you may be able to handle the claim yourself. However, if you have medical bills, lost wages, or lingering pain, you should at least consult an attorney. Insurance companies undervalue claims and pressure victims to accept lowball offers. A lawyer ensures you get the full compensation you deserve. Does paying those fees to a lawyer make sense in a smaller case. The real answer is sometimes yes and sometimes no.

How much does it cost to hire a car accident lawyer in Maryland?

Most car accident lawyers work on a contingency fee basis, meaning you pay nothing upfront. We can only speak for us but we only get paid if they win your case. We front all of the costs of your case and we take a percentage, 33% of the final settlement if your case settles before we file a lawsuit and 40% after that. This structure aligns the lawyer’s interests with yours and ensures they fight for the maximum compensation possible.

Contact Our Maryland Accident Lawyers

We fight to get fair compensation for the victims of car accidents, truck accidents, and motorcycle accidents. Call 1-800-553-8082 to speak to a Maryland accident lawyer experienced in handling auto accident claims or contact us online.

Lawsuit Information Center

Lawsuit Information Center