3M is defending over 280,000 cases alleging that its Combat Arms Earplugs caused military veterans to suffer hearing loss. The 3M earplug litigation is the largest mass tort ever, but until now it has drawn very little attention from investors and financial analysts. That might be about to change. Over the last few days, market analysts from JP Morgan and Morningstar have started to raise some concerns and cautioned that 3M’s earplug liability could potentially be massive.

Background of the 3M Earplug Litigation

For over a decade, 3M’s Combat Arms Earplugs were standard issue equipment for all U.S. Military service members. The earplugs were supposed to protect soldiers from hearing loss from loud noises, but in 2018 3M settled a false claims lawsuit with the U.S. Government alleging that 3M knew that design defects in the earplugs made them ineffective.

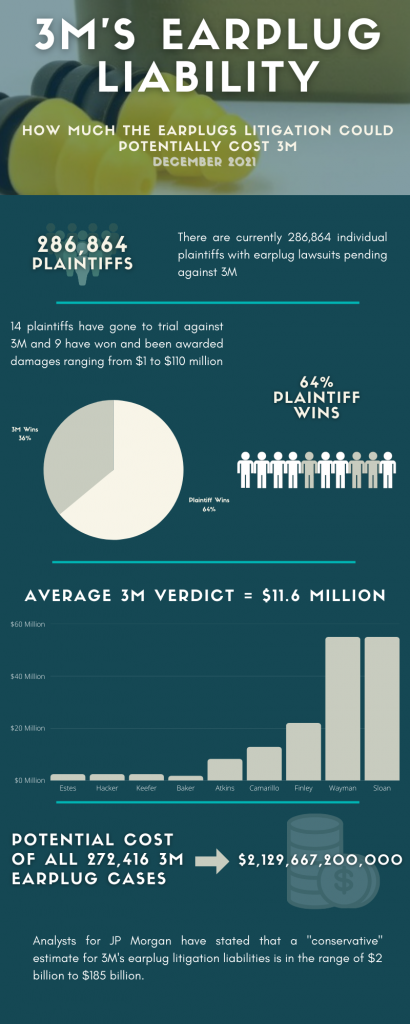

The settlement of the false claims act case with the government prompted a wave of product liability lawsuits against 3M by current and former service members alleging that they suffered hearing loss from the defective earplugs. At last count, there were around 280,000 earplug lawsuits pending against 3M and consolidated into an MDL in federal court in Florida.

Over the last 12 months, 11 earplug lawsuits have gone to trial as part of the bellwether test trial program in the MDL. 3M has won defense verdicts in 5 of these bellwether trials, while the plaintiffs have won victories in the other 6. The most recent bellwether trial ended last month in a blockbuster verdict in which $110 million was awarded to a pair of army veterans.

Altogether, juries in the test trials have awarded over $160 million in damages. There are 5 more bellwether test trials scheduled between now and May. After that, the pace of trials is set to accelerate dramatically, and 3M could be defending jury trials across the country each involving dozens of plaintiffs.

3M Earplug Liability Flies Under the Radar

Despite the massive size of the 3M earplug litigation, it had generated surprisingly little attention or concern from Wall Street and 3M investors. Although 3M’s stock is down around 19% since 2018, this decline has had nothing to do with concern about the company’s potential liability in the earplug litigation.

Until very recently, most of the negative attention has been focused on 3M’s potential exposure in a different mass tort involving polyfluoroalkyl chemicals, known as PFAS. This litigation involves a complex maze of lawsuits brought by individuals as well as states and local municipalities claiming that 3M’s PFAS contaminated water supplies. 3M has repeatedly disclosed the PFAS litigation as a future liability risk in its earnings reports and it has draw intense caution and speculation.

Until very recently, however, almost no mention has been made about 3M’s future liability risk for the earplug litigation. The earplug lawsuits have never been named as a future risk in 3M’s financial disclosures and they have not reserved any funds to cover liabilities for the litigation. Instead, in regulatory filings 3M has stated that liability in the earplug litigation is “not probably and reasonably estimable at this time.”

3M’s refusal to acknowledge the potential liability risk associated with the earplug lawsuits and the excessive focus on the PFAS litigation allowed what could be a massive liability to go almost unnoticed for nearly 2 years.

Blockbuster Verdict Brings Attention to 3M Earplug Risk

The relative anonymity of the 3M earplug litigation effectively ended last month when the 11th earplug test trial (known as a “bellwether trial”) resulted in a massive, attention-grabbing verdict of $110 million. The previous 10 bellwether trials generated mixed results with 3M winning defense verdicts in half of the cases, with the largest verdict being $22.5 million.

At the end of January, however, a federal jury in the Sloan/Wayman test trial awarded 2 army veterans $110 million, including $80 million in punitive damages. The size of the verdict dwarfed the results of the previous trials and brought the earplug litigation out of the shadows.

Yesterday, Bloomberg posted a story highlighting the potentially massive size of 3M’s liability risk in the earplug lawsuits. The story featured comments from 2 prominent market analysts, Joshua Aguilar from Morningstar Investment Service and JP Morgan’s Steve Tusa, offering sobering estimates on 3M’s potential litigation liabilities.

According to Tusa, the earplug litigation is “currently underappreciated by investors,” and a “conservative” estimate for 3M’s potential earplug liability is $2 billion to $185 billion. Tusa described the 3M earplug litigation as a “potential liability watch item that could be sizeable.” Aguilar echoed these concerns and described 3M’s earplug litigation liability as “the elephant in the room.”

The Bloomberg story and the comments from Tusa and Aguilar mark the first noticeable shift in the narrative on the 3M earplug litigation. We have been closely following the news and reactions on the earplug litigation front and this is the first time we have seen anyone in the financial world recognize the potential implications of the earplug litigation for 3M.

No matter how hard 3M tries to ignore them, 280,000 earplug lawsuits are not going to simply go away. 3M has repeatedly expressed its intent to “vigorously defend” the claims but taking 280,000 cases to trial is simply not possible. Even if the cases are tried in large groups, they would overwhelm the court system and the defense costs alone would run into the billions.

In any event, the results of the bellwether trials suggest that 3M would lose at least half of the trials anyway, which would mean 140,000 verdicts. Even if the average verdict award were just $1 million (which is way less than the actual average so far), that would work out to $140 billion.

3M has also claimed that it plans to battle the earplug verdicts on appeal, but 3M’s legal arguments have already been considered and flatly rejected by the federal judge assigned to the MDL. It is highly unlikely that 3M will get a different result on appeal.

Lawsuit Information Center

Lawsuit Information Center